Near-Term Forecast Puts Global Valve Demand Over $98 Billion

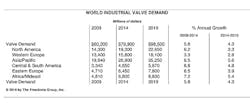

A new market study projects global demand for industrial valves will increase 4.3% annually through 2019, to an estimated value of $98.5 billion. World Industrial Valves, available for purchase from The Freedonia Group Inc., identifies process-manufacturing sectors (including chemicals) as a primary driver for the market. Other areas of strong demand will be, electric power generation and construction activity, in what the authors describe as a “generally healthy economic environment.”

Efforts to expand water infrastructures in developing countries, and to maintain water and wastewater treatment and distribution systems in developed nations, also factor into to the forecast sales increases.

Valve manufacturers’ income will be improved by buyers’ increasing selection of “smart” valves and actuators (i.e., products that contain multiple sensors and are linked to microprocessor-based control systems.) Other new and better performing product designs also factor into sectoral improvements.

Industrial valve demand in developing regions — parts of Asia, the Africa/Mideast region, Central and South America, and Eastern Europe — will outpace demand in Western Europe, Japan, South Korea, and the U.S., Fredonia forecasts. “China will post the strongest advances of any national market in value terms, accounting for 23% of all additional valve sales on a global basis,” offered group leader Ken Long.

The Indian market is smaller, but also offers potential for valve suppliers seeking gains. Several smaller markets (including Indonesia, Malaysia, Thailand, and Turkey) also are forecast to demonstrate noteworthy rises in valve sales.

Valve demand in the U.S. will increase as capital-investment increases in line with improving economic conditions, a trend that will be mirrored in Western Europe and Japan. However, valve demand in those developed regions will trail those in most other parts of the world, because of “below-average increases in process manufacturing output and associated fixed investment expenditures.”

Demand for automatic valves (including control and regulator valves, as well as valve actuators, separately sold) is forecast to grow at a faster rate through 2019 than sales of standard (or conventional) hand-operated valves. Automatic valves will continue to take market share away from standard valves, because of design improvements emphasizing safe operation and lower operating costs.

The fastest sales gains for any major type of valves will be for automatic actuators, driven by valve users’ continuing efforts to automate standard valve operation, rather than full-replacement with automatic valves.

World Industrial Valves (January 2016, 519 pages) is available for $6,300 from The Freedonia Group Inc.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others.